Your Home Equity Can Offset Affordability Challenges

Are you thinking about selling your house? If so, today's mortgage rates may make you wonder if that's the right decision. Some homeowners prefer to sell and take on a higher mortgage rate on their next home. If you're worried about this too, know that even though rates are high right now, so is home equity. Here's what you need to know.

Bankrate explains what equity is and how it grows:

"Home equity is the portion of your home you've paid off and own outright. It's the difference between what the home is worth and how much is still owed on your mortgage. As your home's value increases over the long term and you pay down the principal on the mortgage, your equity stake grows."

In other words, equity is how much your home is worth, minus what you still owe on your home loan.

How Much Equity Do Homeowners Have Now?

Recently, your equity has been growing faster than you might think. To help contextualize just how much the average homeowner has, CoreLogic says:

". . . the average U.S. homeowner now has about $290,000 in equity."

That's because, over the past few years, home prices went up significantly – and those rising prices helped your equity to accumulate faster than usual. While the market has started to normalize, more people still want to buy homes than homes available for sale. This high demand is causing home prices to go up again.

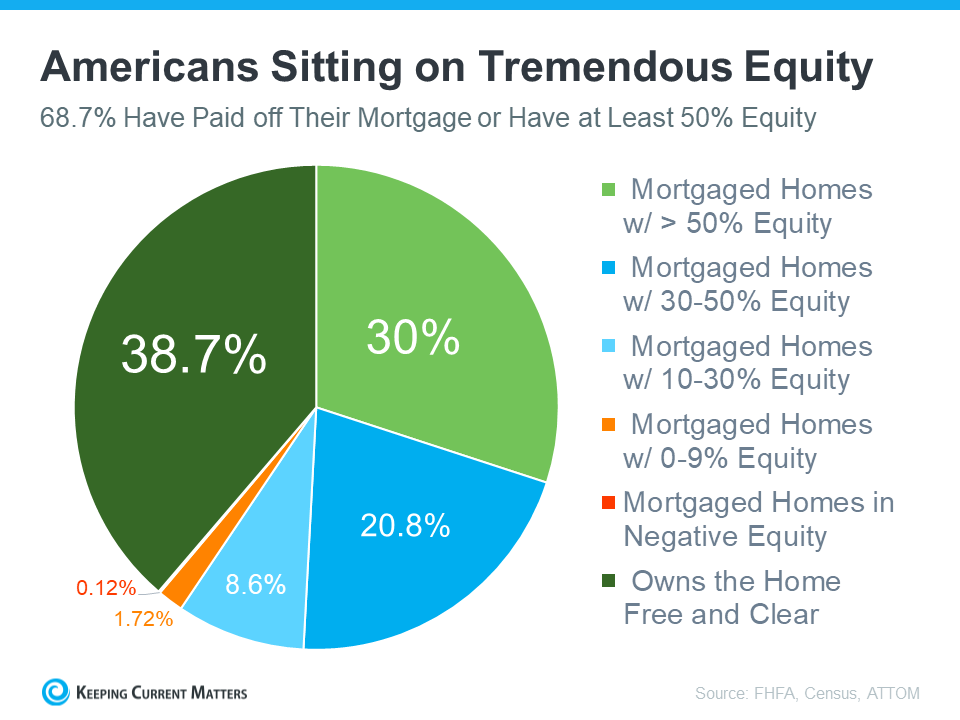

According to the Federal Housing Finance Agency (FHFA), the Census, and ATTOM, a property data provider, nearly two-thirds (68.7%) of homeowners have either fully paid off their mortgages or have at least 50% equity (see chart below):

That means nearly 70% of homeowners have a tremendous amount of equity.

How Equity Helps with Your Affordability Concerns

With today's affordability challenges, your equity can make a big difference when you move. After you sell your house, you can use the equity you've built in your home to help you buy your next one. Here's how:

- Be an all-cash buyer: If you've lived in your current home for a long time, you might have enough equity to buy a new house without taking out a loan. If that's the case, you won't need to borrow money or worry about mortgage rates. The National Association of Realtors (NAR) states:

"These all-cash home buyers are happily avoiding the higher mortgage interest rates . . ."

- Make a larger down payment: Your equity could be used toward your next down payment. It is enough to let you put a more significant amount down, so you won't have to borrow as much money, so today's rates become less of a sticking point. Experian explains:

"Increasing your down payment lowers your principal loan amount and, consequently, your loan-to-value ratio, which could lead to a lower interest rate offer from your lender."

Bottom Line

If you're thinking about moving, the equity you've built up can make a big difference, especially today. Contact The Aaronson Group to find out how much equity you've got in your current house and how you can use it for your next home. Call us 949-388-5194 Email us: info@previewochomes.com