OPEN HOUSE-Saturday, May 27, 2023 from 1-4 p.m.

Posted by The Aaronson Group on

LOADING - 35555 Beach Road

Full details can be found by checking out the 35555 Beach Road MLS Listing

349 Views, 0 Comments

.11.png)

LOADING - 35555 Beach Road

Full details can be found by checking out the 35555 Beach Road MLS Listing

349 Views, 0 Comments

Buying a home can feel intimidating, even under normal circumstances. But today’s market is still anything but ordinary. There continues to be a minimal number of homes for sale, creating bidding wars and driving home prices back up as buyers compete over the available homes.

Navigating this can be daunting if you’re trying to do it alone. That’s why having us at The Aaronson Group to guide you through home-buying is essential, especially today. Bankrate shares this perspective:

“Advice and guidance from a professional real estate agent can be invaluable, particularly amid a hot or unpredictable housing market.

300 Views, 0 Comments

Some Highlights

Contact us: Call 949-388-5194 or email info@previewochomes.com

296 Views, 0 Comments

If you’re considering selling your house, you should know the number of homes for sale right now is low. That’s because, this season, fewer sellers are listing their houses for sale than the norm.

Looking back at every April since 2017, the only year fewer sellers listed their homes was in April 2020, when the pandemic hit and stalled the housing market (shown in red in the graph below). In more typical years, roughly 500,000 sellers add their homes to the market in April. This year, we saw fewer than 400,000 sellers entering the market in April (see graph below):

While several factors contribute to this trend, one thing keeping inventory low right now is that some homeowners are reluctant to move when the mortgage rate they have on their…

398 Views, 0 Comments

If you’re reading headlines about inflation or mortgage rates, you may see something about the recent decision from the Federal Reserve (the Fed). But what does it mean for you, the housing market, and your plans to buy a home? Here’s what you need to know.

Inflation and the Housing Market

While the Fed’s working hard to lower inflation, the latest data shows that the number has improved, but the inflation rate is still higher than the target (2%). That played a role in the Fed’s decision to raise the Federal Funds Rate last week. As Bankrate explains:

“Keeping its inflation-fighting streak alive, the Federal Reserve has raised interest rates for the 10th time in 10 meetings . . . The hikes aimed to cool an economy on fire after rebounding…

302 Views, 0 Comments

There’s been some concern lately that the housing market is approaching a crash. And given some of the affordability challenges in the housing market, along with a lot of recession talk in the media, it’s easy to understand why that worry has come up.

But the data clearly shows today’s market is very different than before the housing crash in 2008. So rest assured, this isn’t a repeat of what happened back then. Here’s why.

It was much easier to get a home loan during the lead-up to the 2008 housing crisis than it is today. Back then, banks had different lending standards, making it easy for anyone to qualify for a home loan or refinance an existing one. As a result, lending institutions took on much more…

416 Views, 0 Comments

If you’re a homeowner considering moving, you may wonder if it’s still an excellent time to sell your house. Here’s the good news. Even with higher mortgage rates, buyer traffic is picking up speed.

Data from the latest ShowingTime Showing Index, which is a measure of buyers actively touring homes, helps paint the picture of how much buyer demand has increased in recent months (see graph below):

As the graph shows, the first two months of 2023 saw a noticeable increase in buyer traffic. That’s likely because the limited number of homes for sale kept shoppers looking for homes even during colder months.

To help tell the story of why the latest report is significant, let’s compare foot traffic this February with each February for the last…

318 Views, 0 Comments

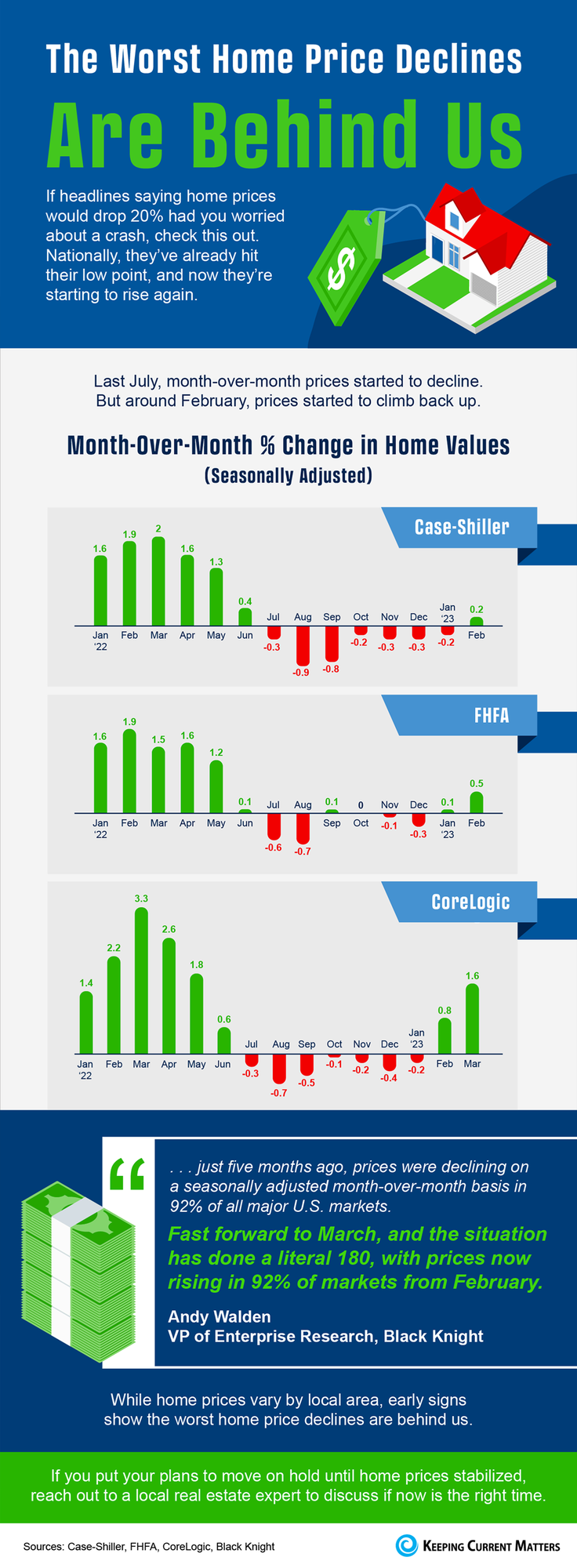

As the housing market changes, you may wonder where it’ll go from here. One factor you’re probably thinking about is home prices, which have come down a bit since they peaked last June. And you’ve likely heard something in the news or on social media about a price crash on the horizon. As a result, you may be holding off on buying a home until prices drop significantly. But that’s not the best strategy.

A recent survey from Zonda shows 53% of millennials are still renting because they’re waiting for home prices to come down. But here’s the thing: the most recent data shows that home prices have bottomed out and are now rising again. Selma Hepp, Chief Economist at CoreLogic, reports:

“U.S. home prices rose by 0.8% in February . . . indicating…

364 Views, 0 Comments

The housing market’s been going through a lot of change lately, and there’s been uncertainty surrounding what will happen this spring. You may be wondering if more homes will go on the market, what’s next with home prices and mortgage rates, or what the best advice is for someone in your current position.

Here’s what industry experts are saying right now about the spring housing market and what it means for you:

“We see more competition among buyers . . . Housing supply also tends to grow during the spring months. And this is also the time of year when relatively more migration happens, as people graduate and move elsewhere looking for jobs.”

“I…

520 Views, 0 Comments

The spring season is warming up in housing as more and more buyers enter the market. And after rising mortgage rates sidelined so many buyers last year, that's a good sign for sellers. Realtor.Com has the latest: "Spring is officially here, and like green shoots emerging from the bleak winter, new data suggests that more buyers are back in the market, although more subdued than a year ago."

We know buyer activity is trending up because of mortgage purchase application data. According to Investopedia: "A mortgage application is a document submitted to a lender when you apply for a mortgage to purchase real estate."

That means the number of mortgage applications shows how many buyers are applying. Put another way, an increase in mortgage…

327 Views, 0 Comments

With over $750 Million in real estate sales, The Aaronson Group offers an unparalleled level of service to our highly respected clients. Whether you are looking to buy or sell your home, we guarantee that our expertise, professionalism & dedication will navigate you towards meeting your unique real estate needs.

Let’s Connect