What Every Seller Should Know About Home Prices

If you’re trying to decide whether or not to sell your house, recent headlines about home prices may be top of mind. And if those stories have you wondering what that means for your home’s value, here’s what you need to know.

What’s happening with home prices?

You may have seen news stories mentioning a drop in home values or home price depreciation, but it’s important to remember these headlines are clickbait. But what headlines aren’t always great at is painting the complete picture.

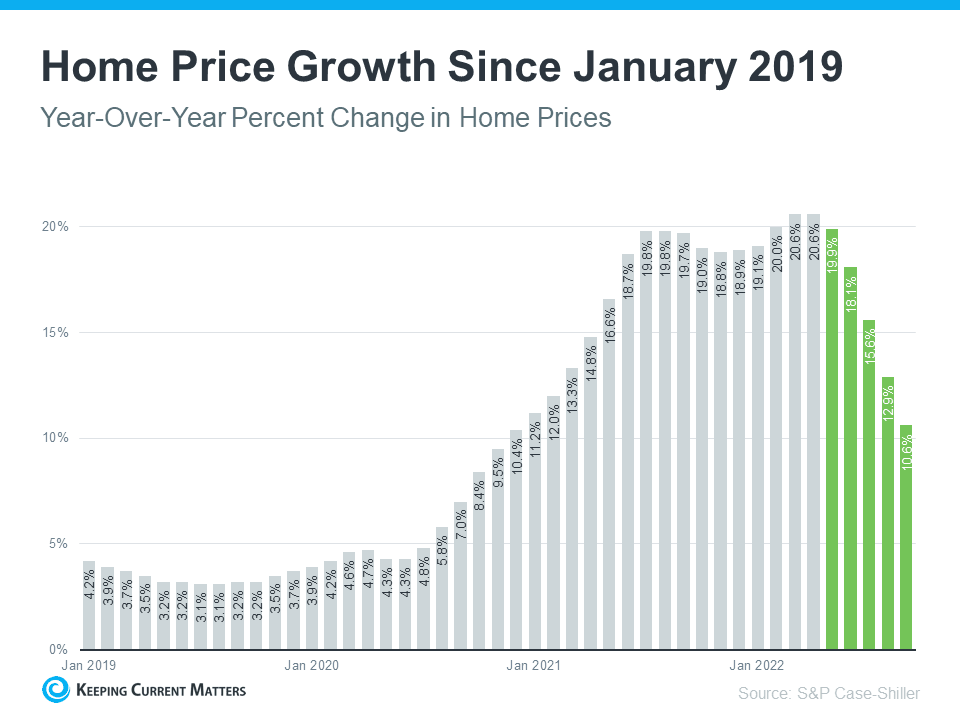

While home prices are down slightly month-over-month in some markets, it’s also true that home values are up nationally on a year-over-year basis. The graph below uses the latest data from S&P Case-Shiller to help tell the story of what’s happening in the housing market today:

The graph shows that its actual home price growth has moderated in recent months (shown in green) as buyer demand has pulled back in response to higher mortgage rates. This home price growth is what the headlines are drawing attention to today.

But what’s important to notice is the more significant, longer-term picture. While home price growth is moderating month-over-month, the percent of appreciation year-over-year is still well above the home price change we saw during more normal years in the market.

The bars for January 2019 through mid-2020 show that home price appreciation of around 3-4% a year was more typical (see bars for January 2019 through mid-2020). But even the latest data for this year shows prices have still climbed by roughly 10% over last year.

What does this mean for your home’s equity?

While you may not be able to capitalize on the 20% appreciation we saw in early 2022, in most markets, your home’s value, on average, is up 10% over last year – and a 10% gain is still dramatic compared to a more normal level of appreciation (3-4%).

The big takeaway? Don’t let the headlines obscure your plans to sell. Over the past two years alone, you’ve likely gained a substantial amount of equity in your home as home prices climbed. Even though home price moderation will vary by market moving forward, you can still use the boost your equity got to help power your move.

As Mark Fleming, Chief Economist at First American, says:

“Potential home sellers gained significant amounts of equity over the pandemic, so even as affordability-constrained buyer demand spurs price declines in some markets, potential sellers are unlikely to lose all that they have gained.”

Bottom Line

If you’re thinking about buying a home, connect with The Aaronson Group for expert advice. Contact 949-388-5194 or email: info@previewochomes.com