The Biggest Questions Clients are Asking This Spring

Buckle up. This spring market is going to be a busy one. Homes are selling fast, and inventory just can’t keep up with the demand. But there are still some big questions surrounding the housing market right now holding back a lot of buyers and sellers.

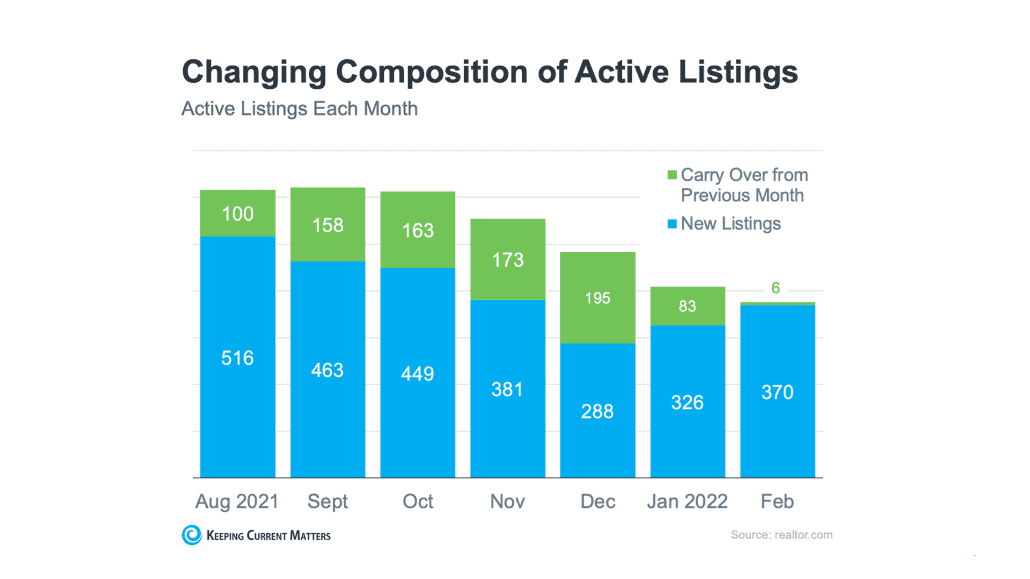

Will we see more inventory this spring?

For the last number of decades, the real estate market has been broken down into seasons with spring reigning as the best time to sell a home. Traditionally, that’s how it’s been. But there’s a big shift happening now. Recent years have seen that seasonality blur as more and more people decide to buy or sell a home no matter what time of year it is. What we do know is that while we’ll probably see more homes hit the market this spring, supply is still too low to keep up with demand. So, even if more homes do come on the market compared to previous months, there are plenty of willing and ready buyers waiting on the sidelines to scoop them up. The best way to prepare your clients for this competitive market is to make sure they’re ready to move fast, be patient and stay flexible.

Why are prices rising so quickly?

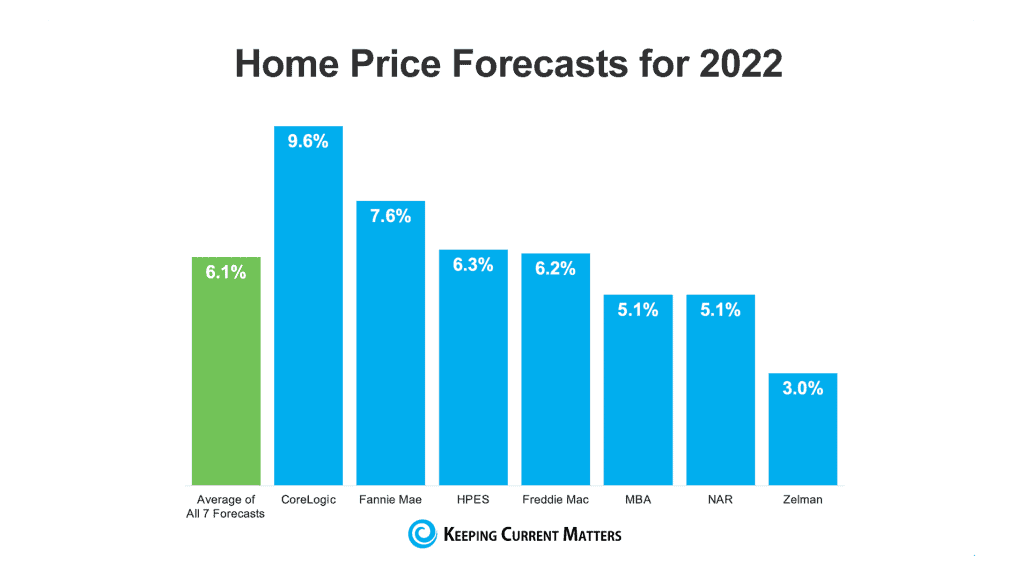

No one wants to buy at the top of the market. We saw how that played out in 2008, and it didn’t end well for a lot of homeowners. According to recent expert projections, we aren’t at the top of the market. But before we dive a little deeper into that, we need to explain a couple of things. First, with both Millennials and Gen Z now in the buyer group, there isn’t enough existing inventory to keep up with the number of aspiring homeowners. Second, we didn’t build enough homes in the last decade to keep up with the demand. This leads us directly to our next big question.

Should I wait to buy until prices go down?

So, with the existing inventory not being able to keep up with the number of buyers looking to own a home, we are seeing price appreciation that looks strikingly similar to what we saw in the years leading up to the crash. The big difference between now and then is this: this price appreciation is a direct result of low inventory and high demand. Not high inventory and high demand like in the early 2000s. Plus, earlier projections by top industry experts are already being revised to higher than originally anticipated. That means more likely than not, we could see another year of above-average price appreciation.

How will rising inflation impact the housing market?

Inflation: one of the most unfortunate results of the pandemic. And there have obviously been many (let’s never forget the infamous toilet paper shortage). But inflation isn’t new. And if we look all the way back to 1970, we actually see one big takeaway: homeownership is historically a great hedge against it. For example, as rental prices continue to rise nationwide, locking in mortgage payments can keep your largest monthly cost the same. Remain the same. Another big takeaway: home price appreciation has outperformed inflation for decades.

Should I wait until prices go down to buy?

Industry experts are projecting that prices will only go up from here (and that’s not likely to change anytime soon). There are many benefits to homeownership that have consistently been the best long-term investment a person can make in their life. And waiting for the market to cool off or prices to go down means only one thing: paying more for the exact same house. Especially as experts project mortgage rates will continue to rise. Don't be hesitant to hop into this hot market is this: you can wait, but it will probably cost you.

Bottom line

If you’re thinking of buying, act now before mortgage rates and home prices increase further. If you’re thinking of selling, your best bet may be to sell soon so you can beat the increase in competition that’s about to come to the market. Contact The Aaronson Group today. Call: (949) 388-5194 or Email: info@previewochomes.com