Should You Renovate or Move?

Recently, the American Institute of Architects released their AIA Home Design Trends Survey results for the third quarter of 2021. The survey revealed the following:

- 70% of respondents want more outdoor living space

- 69% of respondents want a home office (48% wanted multiple offices)

- 46% of respondents want a multi-function room/flexible space

- 42% of respondents want an au pair/in-law suite

- 39% of respondents want an exercise room/yoga space

If you currently own a home you have two options: renovate your current house or buy a home that has what you desire. The decision you make could be determined by factors like:

- A desire to relocate

- The cost of a renovation versus a purchase

- Designing a new home or buy something that has what you want

Whatever you decide, you’ll need access to capital: the funds for the renovation or the down payment your next home would require. It is highly likely that capital already exists in your current home in the form of equity.

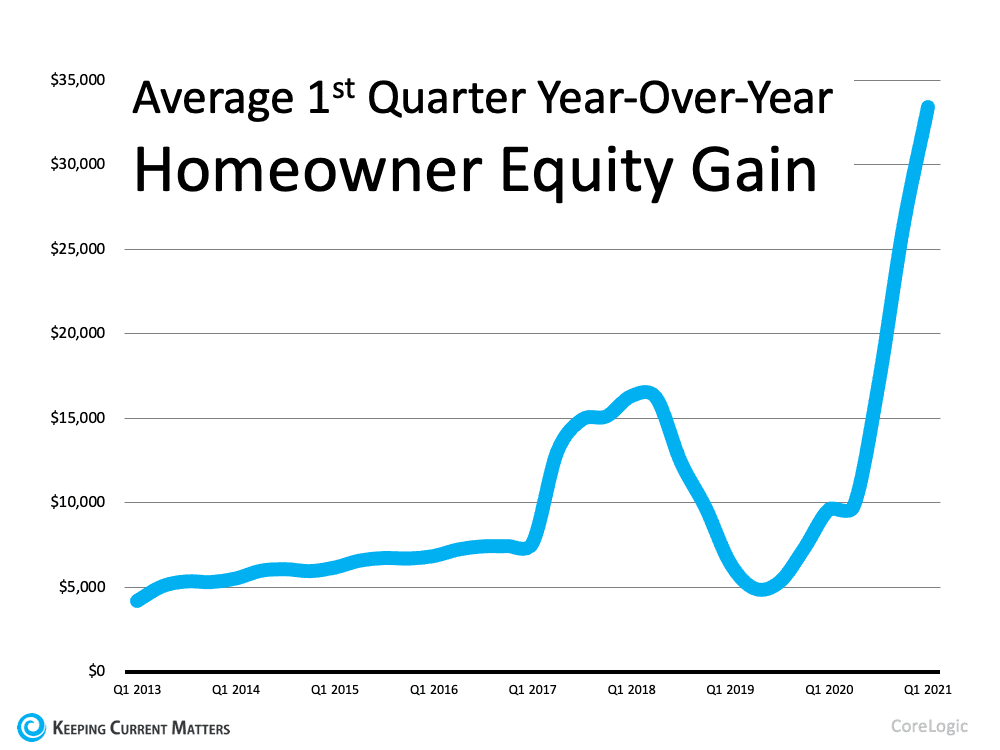

In the last two years, the equity in most homes has skyrocketed. The graph below contains data collected from the financial services company, CoreLogic, the average home equity gain of the first quarter in the last nine years.

Odeta Kushi, Deputy Chief Economist at First American, assess the amount of equity homeowners gained recently:

“Remember U.S. households own nearly $35 trillion in owner-occupied real estate, just over $11 trillion in debt, and the remaining ~$24 trillion in equity. In inflation-adjusted terms, homeowners in Q2 had an average of $280,000 in equity- a historic high.”

You may have the money at your fingertips to renovate or find your perfect home. Waiting to leverage your equity will probably mean you’ll pay more to do so.

Mortgage rates are expected to increase over the next year. According to the latest data from the Federal Housing Finance Agency (FHFA), almost 57% of current mortgage holders have a mortgage rate of 4% or below. If you’re one of those homeowners, you can keep your mortgage rate under 4% by doing it now. If you’re one of the 43% of homeowners with a mortgage rate over 4%, you may be able to do a cash-out refinance or buy a more expensive home without significantly increasing your monthly payment.

What you need to do is determine is how much equity you have in your current home. Here's how:

- The current mortgage balance on your home

- The current value of your home

To find out the current market value of your house, you can pay for an appraisal (usually several hundred dollars), or you can contact The Aaronson Group who will be able to present to you for free, a professional equity assessment report.

If you are thinking about what you want from your house, now may be the time to either renovate or move to your dream home.

We are here for you! Contact The Aaronson Group at 949-388-5194 or email info@previewochomes.com