Housing Wealth: The Missing Piece of the Affordability Equation

Today, the real estate market is soaring. The values of residential homes are rising, and that’s fantastic for homeowners. In 2020, there was a double-digit increase in home values – a trend also occurring in 2021.

However, due to skyrocketing prices, some are questioning the affordability in this current housing market. Experts in the field of Real Estate emphasize that homes today are less affordable now than they were last year. Black Knight, a leading provider of data and analytics across the homeownership life cycle, reported on the issue.

The historical averages of the national payment to income ratio, defined as “the share of the median income needed to make the monthly payments on the median-priced home.” The study reveals:

- The average over the last 25 years was 23.6%

- The average over the last 5 years was 20.1%

- The average today stands at 20.5%

Currently, housing payments are somewhat less affordable than the five-year average – but only by less than ½ a percentage point. Yet, they’re significantly more affordable than the 25-year average. Case in point, a buyer will likely make a slightly greater financial sacrifice to afford a home right now than if they purchased a home within the last five years. On the flip side, it also means that possibly the financial sacrifice is not nearly as great as it was over the last 25 years.

Does making a sacrifice to buy a home now make financial sense in the long term?

Last week, the Federal Reserve announced that in part of the first quarter household net worth grew by $968 billion based merely on the values of the real estate they owned. According to Property Data Leader, CoreLogic, revealed the average annual gain in homeowner equity was $33,400 per borrower.

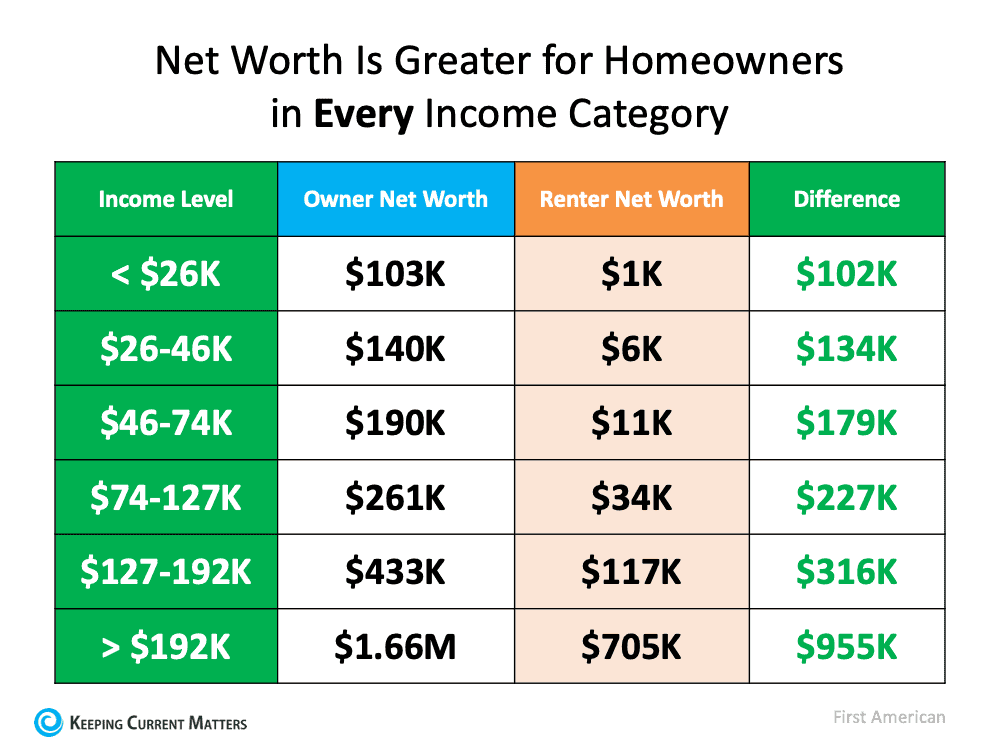

Homeownership continues to be the cornerstone to building personal wealth. For most people in the United States, a home is the largest asset they own. The difference between the net worth of homeowners and renters is significant at every income level. Here’s a table detailing that point using data from a study done by First American:

Owning a home is essential to growing a household’s net worth. The payoff of starting to build equity now will be worth it, despite the slightly greater sacrifice in the percentage of monthly income you’ll spend on housing today.

Bottom Line

When one considers the equity gain and weighs the long-term benefits of building your net worth, one may question if they can afford not to buy now. Home prices have risen dramatically over the past 18 months, it’s slightly less affordable to buy a home today than it was a year ago. Nonetheless, consider the equity gain and weigh the long-term benefits of building your net worth, you may question if you can afford not to buy now.