3 Charts That Show We Are Not in a Housing Bubble

Home prices are delivering double-digit increases, so the concern is great if we are headed into a housing bubble, like the one in 2006. However, market data indicates that the housing market is steady and is not headed for a housing bubble.

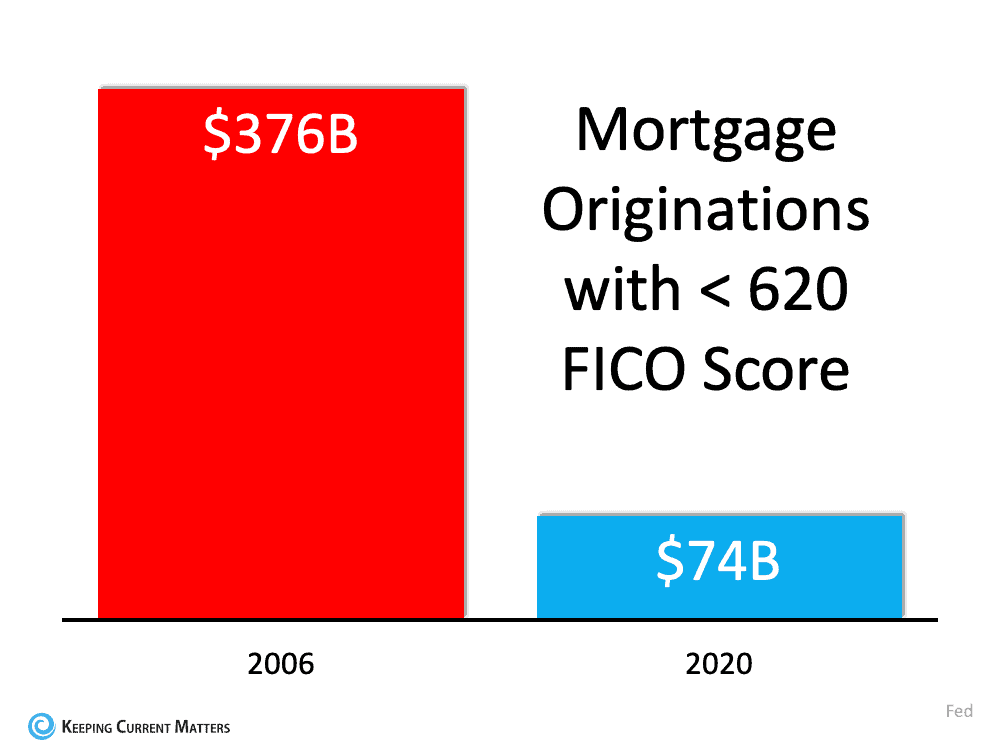

1. The housing market is not driven by high-risk mortgage loans.

The availability of mortgage money is based on the Mortgage Credit Availability Index (MCAI) from the Mortgage Bankers’ Association. In 2006, nearly everyone could qualify for a mortgage loan. The higher the number, the easier it is to access receiving a loan. The index was 869 in 2006. Today, it is at 130. As an example of the difference between today and 2006, let’s look at the volume of mortgages that originated when a buyer had less than a 620 credit score.

Dr. Frank Nothaft, Chief Economist for CoreLogic, reiterates this point:

“There are marked differences in today’s run-up in prices compared to 2005, which was a bubble fueled by risky loans and lenient underwriting. Today, loans with high-risk features are absent, and mortgage underwriting is prudent.”

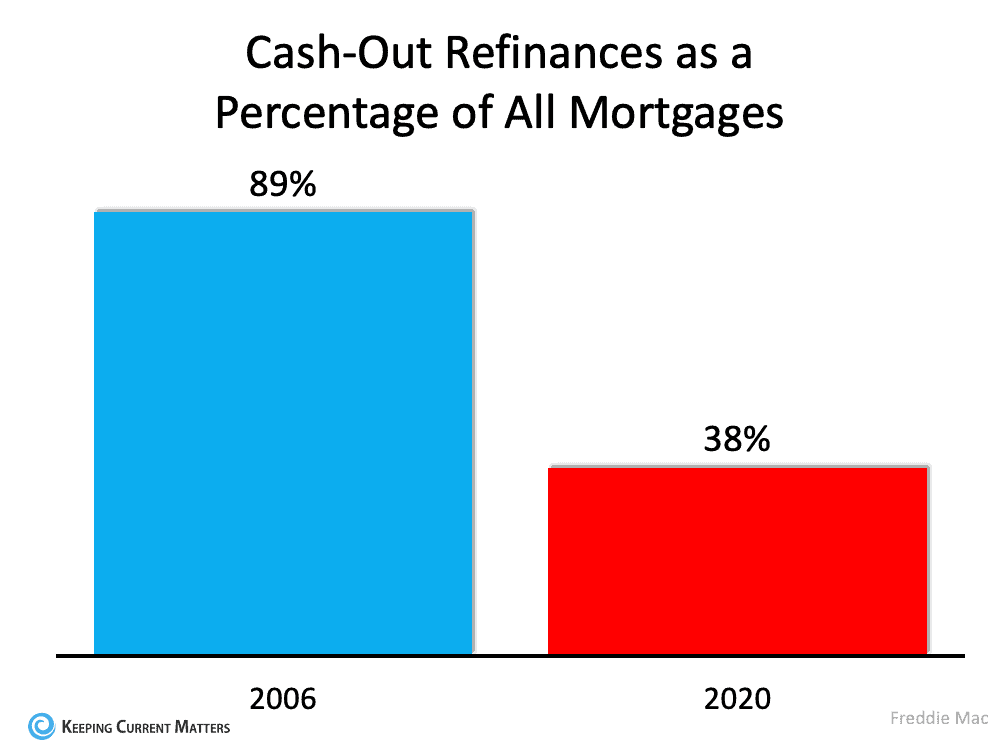

2. Homeowners aren’t using their homes as ATMs this time.

During the housing bubble, as prices for homes shot up, people refinanced their homes and took out large sums of money. Unfortunately, as home values plummeted where people refinanced, this created a negative equity position.

Today, people are letting their equity build. If they refinance, they have enough equity to not be in the negative equity situation.

The percentage of cash-out refinances (where the homeowner takes out at least 5% more than their original mortgage amount) is half of what it was in 2006.

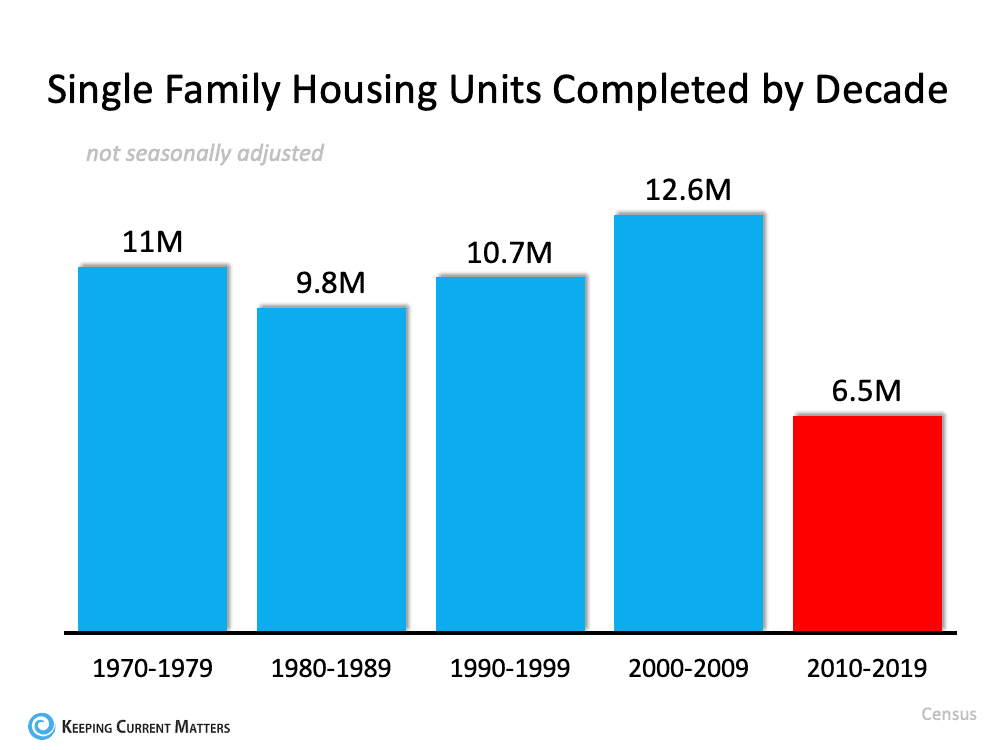

3. This time, it’s simply a matter of supply and demand.

Back in 2006, there were enough homes in supply to keep up with the demand. As a result, homebuilders overbuilt during this time as well. Now, there is a pullback to build single-family homes.

Sam Khater, VP and Chief Economist, Economic & Housing Research at Freddie Mac, explains that pullback is the major factor in the lack of available inventory today:

“The main driver of the housing shortfall has been the long-term decline in the construction of single-family homes.”

Here’s a chart that quantifies Khater’s remarks:

There are not enough homes to keep up with the demand.

Bottom Line

Today's housing market is nothing like 2006. Bill McBride, the author of the prestigious Calculated Risk blog, predicted the last housing bubble and crash. This is what he has to say about today’s housing market:

“It’s not clear at all to me that things are going to slow down significantly soon. In 2005, I had a strong sense that the hot market would turn and that, when it turned, things would get very ugly. Today, I don’t have that sense at all because all of the fundamentals are there. Demand will be high for a while because Millennials need houses. Prices will keep rising for a while because inventory is so low.”